Sammi Fisch & Logan Knecht

Financial Professionals

The Smarter Way To Buy Life Insurance

Apply today for life insurance coverage that can protect your family if LIFE hits the fan. Get an instant estimate today on life insurance that can protect your family plus give you an opportunity to grow long-term wealth.

Sammi Fisch & Logan Knecht

Financial Professionals

The Smarter Way To Buy Life Insurance

Apply today for life insurance coverage that can protect your family if life hits the fan. Get an instant estimate today on life insurance that can protect your family plus give you an opportunity to grow long-term wealth.

Do I need Life Insurance?

Life insurance is a way to protect the financial security of the people who depend on you, whether it be a spouse, children, or extended family. It can help cover expenses such as the mortgage, debts, and the cost of maintaining a certain standard of living. It can also provide financial support for children's education, such as paying for college tuition. While some employers offer life insurance benefits, personal policies are not tied to your employment and can be carried throughout your lifetime. At Main Account, we are here to assist you in understanding and choosing the right life insurance options for your needs and those of your loved ones. We understand that purchasing life insurance can be daunting, which is why we are here to help and support you every step of the way.

What type of Life Insurance do I need?

That depends on a variety of factors, including how long you need coverage for, how much you want to pay and whether you’re looking for a life insurance policy that builds cash value over time.

-Term Life Insurance

All types of life insurance fall under two main categories:

Term life insurance. These policies last for a specific number of years and are suitable for most people. If you don’t die within the time frame specified in your policy, it expires with no payout.

Permanent life insurance. These policies last your entire life and usually include a cash value component, which you can withdraw or borrow against while you’re still alive.

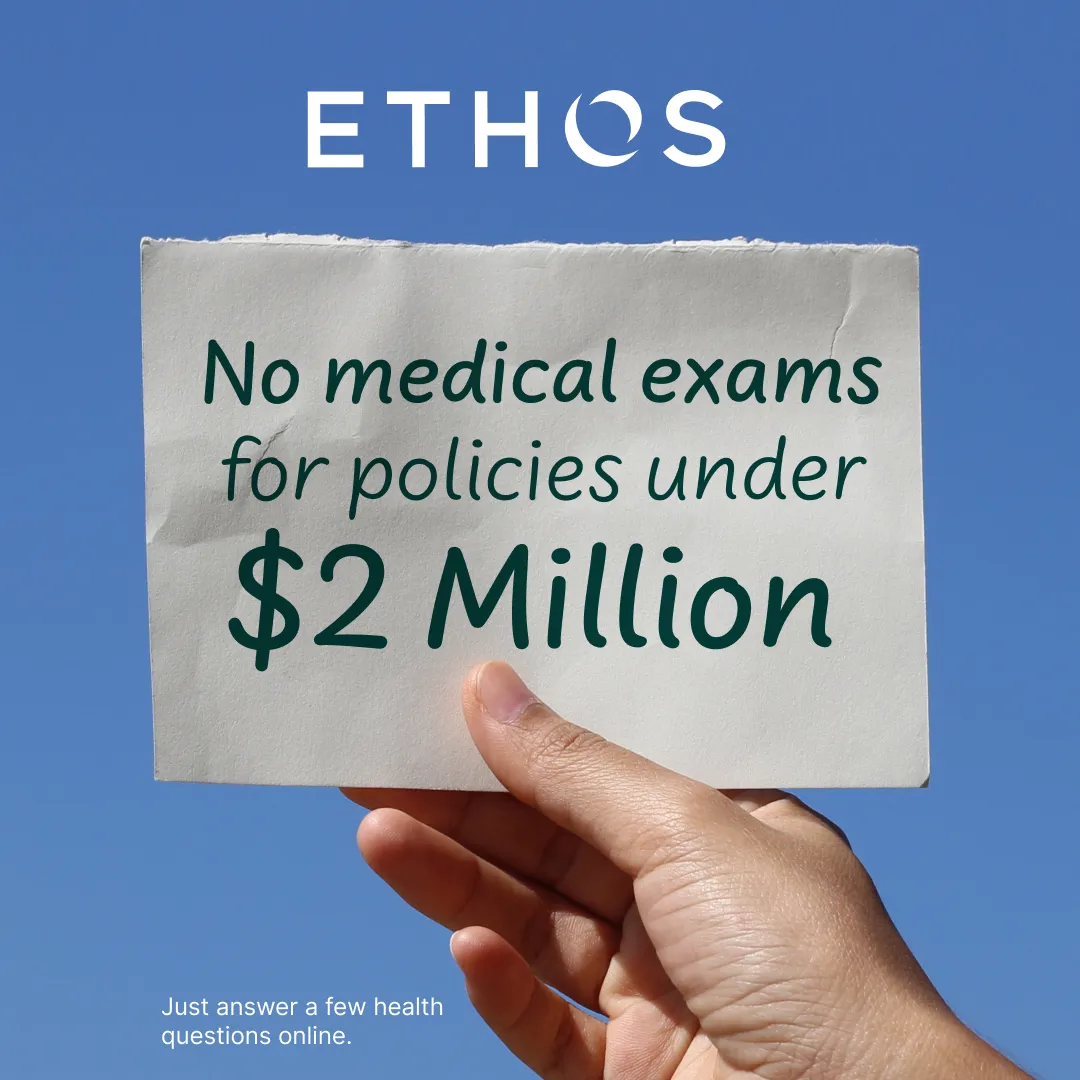

Get Life Insurance In Minutes With ETHOS

Up to $2M in coverage, 95% approvals

The Smarter Way To Buy Life Insurance

Apply today for life insurance coverage that can protect your family if life hits the fan. Get an instant estimate today on life insurance that can protect your family plus give you an opportunity to grow long-term wealth.

Sammi Fisch & Logan Knecht

Financial Professionals

The Smarter Way To Buy Life Insurance

Apply today for life insurance coverage that can protect your family if LIFE hits the fan. Get an instant estimate today on life insurance that can protect your family plus give you an opportunity to grow long-term wealth.

Do I really need to buy life insurance for my young child?

What is more important to you, your child or your car? Both are insured. Why not something that is as important as your children? Buying life insurance for a child forces us to think about the unthinkable. A child's policy isn't just about protecting them in case the unthinkable happens; it's also about ensuring their financial future as well. Children are usually insurable without undergoing medical underwriting - the parents answer a few medical questions. If the policy remains in force, the child will always be insured. When a child reaches certain life milestones, most insurance policies offer optional riders so they can increase insurance coverage.

Can I use my life insurance policy cash value to help with buying a home?

You can get the policy cash value by withdrawing it or borrowing it from the insurance company using the policy as collateral. If you take a withdrawal, your policy value will get reduced right away. If you take out a loan, you can increase your policy values, depending on the type. You don't have to repay the loan, or the interest on it, during your lifetime. If you don't do it, any outstanding loan balance will reduce the amount of death benefit payable to your beneficiary. Find out more from one of our licensed professionals.

Why is life Insurance Worth it?

Life insurance has many reasons for being critical. Ensuring your family's financial security and peace of mind is essential. If anyone is dependent on your income, they would most likely suffer if you passed away. That's why life insurance is so important to have. There are different life insurance policies, but they all pay cash to your loved ones when you die. Daily living expenses, mortgage or rent payments, outstanding loans, college tuition, and other essential costs can be covered by life insurance. If you and your income were to disappear, life insurance can ensure that your family would be taken care of financially. No one knows the future. Ensure the unknown future with policies that give you flexibility and protection for your legacy.

What is the cost of these policies?

The biggest factor is age. There's an old saying that life insurance is like fun. The younger you are, the lower the cost. The older you are, the more expensive it is. If you choose an appropriate strategy for a child, it could cost as little as $50 to $200 per month. Set up a 45-minute Zoom and we'll show you some examples. For children and young adults (40 or younger), the costs are very low. ***These are just preliminary estimates***

I have a "free" life insurance with my current company. Is that good?

In spite of the appeal of a "free" life insurance policy with your current employer, you should understand the limitations. This question may not be ideal for evaluating the suitability of a life insurance policy because:

Often, employers offer "free" life insurance policies that are inadequately covered. You might leave your loved ones financially vulnerable if you pass away due to a minimal death benefit. You may lose coverage if you change jobs or leave the company, leaving you without life insurance protection. Employer-provided life insurance is typically based on your employment. Long-term financial security can be hindered by this lack of portability.

A lack of customization: Employer-sponsored policies tend to be group plans, so they don't offer you customized coverage. Individual life insurance policies don't often come with riders or living benefits that make them more flexible and comprehensive.

Employer-provided life insurance depends on your employment status. The coverage may also be lost if you lose your job or retire, leaving you without protection during critical life events.

Individual life insurance policies can be tailored to your specific circumstances and provide comprehensive protection and flexibility that meets your evolving needs..

Get In Touch

Contact Us Today

Sammi Fisch & Logan Knecht

Sammi Fisch & Logan Knecht

(714) 271-4068

(714) 271-4068